In the fast-paced world of financial technology, speed, flexibility, and trust are no longer just advantages—they’re necessities. Whether you are a fintech startup, a financial institution, or a tech company looking to enter the payments or digital banking space, choosing the right platform can determine how quickly and successfully you go to market.

This is where Fintech Platform shines. Recognized for its ultra-fast launch times, complete customization, and robust security, it has quickly become one of the most trusted white-label fintech software solutions on the market. But what exactly sets it apart from other providers? Let’s take a closer look.

1. Launch Your Fintech Solution in Just One Day

One of the most compelling features of Fintech Platform is its unmatched speed to market. Traditional fintech development can take months—or even years—due to complex integrations, regulatory considerations, and security requirements.

With Fintech Platform, businesses can launch their own branded fintech solution in just 24 hours. This is possible thanks to their pre-built, ready-to-deploy infrastructure combined with a personalized onboarding process. This means you can skip the lengthy coding cycles and focus immediately on customer acquisition and growth.

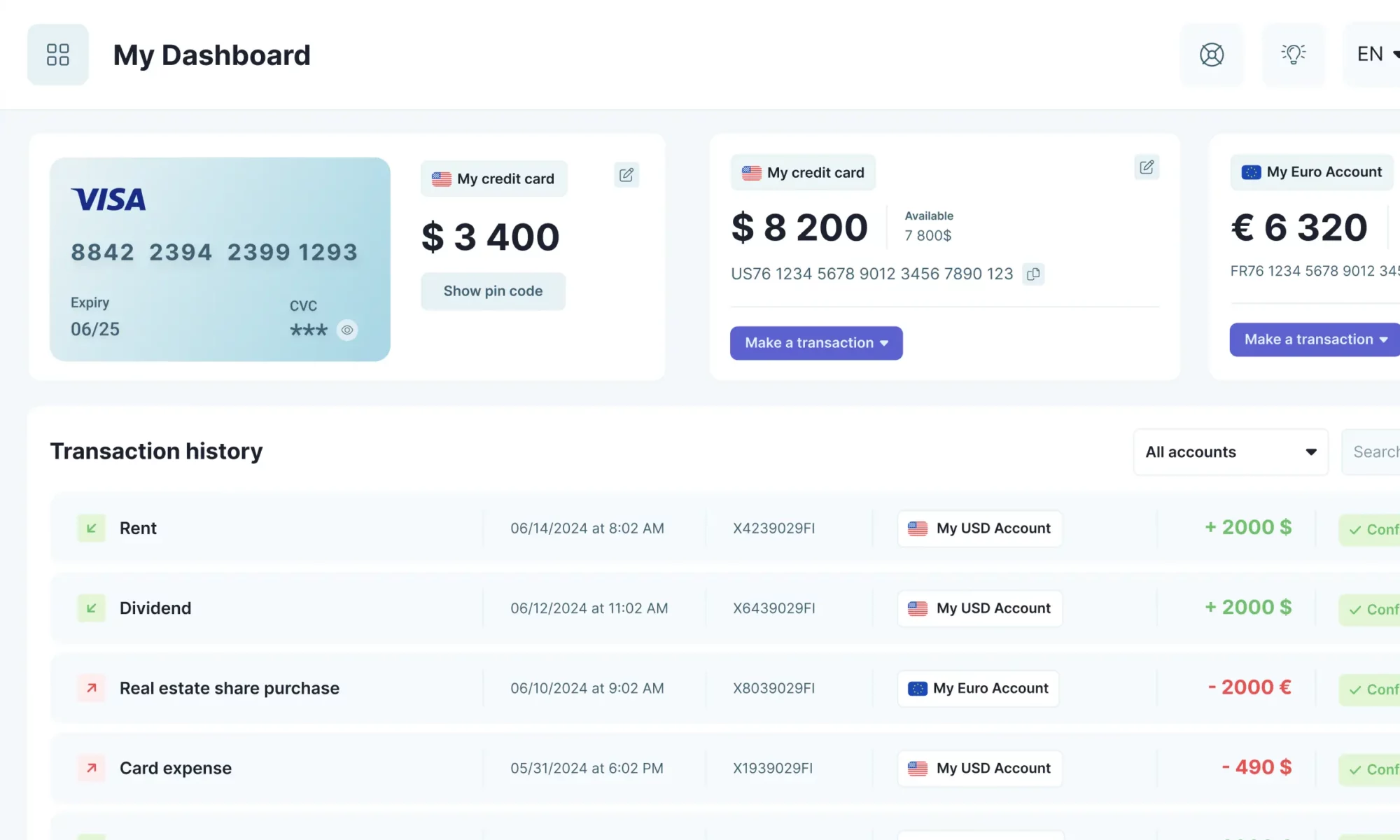

2. Fully Customizable, Truly White-Label

Many companies offer “white-label” solutions, but often these still carry traces of the vendor’s branding or come with significant design limitations. Fintech Platform takes white-labeling to the next level:

-

100% brand control – From logos to color palettes, every visual element can be tailored to match your corporate identity.

-

Custom workflows – The platform doesn’t just change its look; you can configure it to reflect your processes and customer journey.

-

Dedicated database – Your data is stored separately, ensuring data sovereignty and avoiding vendor lock-in.

This means your end users won’t even know you’re using a third-party platform—they’ll experience it as a product built entirely by your company.

3. Powerful API for Unlimited Extensibility

In today’s fintech ecosystem, integration is key. You may need to connect to CRMs, payment gateways, fraud prevention tools, KYC services, or data analytics platforms.

Fintech Platform offers a robust API layer that allows developers to:

-

Integrate third-party services effortlessly

-

Automate back-office processes

-

Extend platform functionality without rebuilding core systems

This flexibility is a huge advantage for businesses that want to innovate quickly without compromising stability.

4. Personalized Onboarding and Expert Support

A major frustration with many SaaS and fintech software providers is the lack of hands-on onboarding. Businesses are often left with generic documentation and slow support tickets.

Fintech Platform takes a human-centered approach. Every new client is assigned a dedicated expert who:

-

Handles the setup and configuration

-

Advises on best practices for automation and integrations

-

Ensures your team understands how to use every feature

This proactive support model reduces learning curves, minimizes errors, and gets your operations running smoothly from day one.

5. Security and Compliance at the Core

Security is non-negotiable in fintech. With ever-tightening regulations and growing cyber threats, businesses need to ensure their platforms meet the highest standards.

Fintech Platform’s architecture prioritizes:

-

Secure data storage in isolated databases

-

Role-based access controls

-

Compliance-ready frameworks adaptable to multiple jurisdictions

Their system isn’t just secure—it’s designed to adapt as compliance requirements evolve, protecting both you and your customers.

6. Continuous Improvement Driven by Customers

One of the hallmarks of Fintech Platform is its commitment to innovation. The company releases weekly updates, incorporating feedback from its client base to ensure the platform always reflects real-world needs.

Instead of a stagnant product that ages quickly, you get a constantly evolving solution—ensuring your fintech offering stays competitive without the heavy lift of constant internal development.

7. Transparent, Scalable Pricing

Cost predictability is crucial when launching a fintech product. Fintech Platform offers straightforward pricing ranging from €600 to €2,000 per month, depending on the feature set and level of customization.

Even better, new companies can qualify for a 50% discount for their first six months. This makes it accessible to startups while still providing enterprise-grade capabilities. As your business grows, the platform scales with you—both in features and performance.

8. Why Businesses Choose Fintech Platform Over Competitors

While many white-label fintech providers offer some of these features, Fintech Platform uniquely combines all of them:

-

Speed → Launch in one day, not months

-

Customization → True white-label, brand-aligned interface

-

Security → Dedicated databases, compliance-ready

-

Integration → Powerful API for limitless expansion

-

Support → Dedicated onboarding expert

-

Affordability → Startup-friendly pricing with growth potential

This rare combination means you don’t have to choose between agility, quality, and cost—you get all three.

9. Industries and Use Cases

Fintech Platform’s flexibility makes it ideal for a variety of business models, including:

-

Digital banks & neobanks

-

Payment processors

-

Lending platforms

-

Investment & wealth management apps

-

Crypto exchanges and wallets

-

Financial marketplaces

By adapting to each use case, it ensures you only pay for the tools you need, while still having the freedom to expand into new services later.

10. Future-Proof Your Fintech Business

The fintech sector is evolving rapidly, with trends like embedded finance, blockchain, and AI-powered analytics shaping customer expectations. Choosing a platform that can adapt quickly to new trends is crucial.

Fintech Platform’s agile development cycle, API-first approach, and customer-driven roadmap make it a future-proof choice—ensuring your product can keep pace with technological and regulatory shifts.

Final Thoughts

If your goal is to bring a fintech product to market quickly, securely, and cost-effectively—without sacrificing brand identity or flexibility—Fintech Platform is hard to beat.

With its one-day launch capability, full customization, seamless integrations, and personalized support, it empowers businesses to succeed in one of the most competitive industries in the world. Whether you’re a startup or an established financial player, this platform delivers the tools, speed, and confidence you need to grow.

Visit fintech-platform.com to see how you can launch your own branded fintech solution today—and join the companies redefining financial services for the digital age.