Cloud marketplaces are exploding. Forrester finds that buyers deploy third-party software in roughly half the time when they purchase through AWS Marketplace, and analysts forecast revenue to soar from $16 billion in 2023 to $85 billion by 2028 as channel partners jump in. Speed alone, though, won’t guarantee profit for managed service providers. Margins, automation, and brand control still separate front-runners from followers. In this guide, we’ll stack TD SYNNEX’s multi-cloud StreamOne Ion against AWS Marketplace and spotlight three other platforms every growth-minded MSP should consider.

What MSPs should look for in a cloud marketplace

Marketplace sites may tout “best in class,” yet eight measurable factors separate real profit engines from glossy storefronts:

- Catalog breadth and vendor fit. Your marketplace should offer enough choice. AWS now hosts more than 15,000 third-party listings, while broadline distributors such as Ingram Micro Cloud aggregate more than 200 vendors, so you avoid juggling extra supplier accounts.

- Provisioning and billing automation. Insist on one-click ordering, PSA connectors, and real-time usage feeds that wipe out spreadsheets and protect cash flow.

- Predictable partner margin. Hyperscalers often add about a five percent transaction fee. Distributor models bake a reseller discount into every SKU, so you set the mark-up.

- White-label experience. A customer-facing portal carrying your logo keeps the relationship, and therefore renewals, in your hands.

- Multi-cloud coverage. One console that sells Microsoft 365, Azure, AWS, Google Cloud, and SaaS prevents vendor lock-in and lets you bundle services on a single invoice.

- Support and enablement. Solution architects, migration help, and playbooks shorten projects and close deals faster.

- Security and compliance safeguards. Verified listings and clear data-handling standards lower risk for regulated clients.

- Global reach. If you serve multinationals, demand local-currency billing and regional tax handling across dozens of countries.

Catalog and ecosystem reach

AWS Marketplace is still the largest single-cloud storefront, offering more than 15,000 software and data listings as of mid-2025. If your clients standardize on Amazon Web Services and want every tool—firewalls, AI services, data feeds—inside the same tenant, that breadth is hard to beat.

StreamOne Ion swaps raw count for multi-vendor coverage. From one console, you can resell Microsoft 365, spin up Azure virtual machines, pass through AWS consumption, and add Google Cloud or third-party SaaS. StreamOne now supports 80-plus countries, giving you the range to place Microsoft seats, an AWS workload, and a niche backup app on a single invoice without opening three portals. According to TD SYNNEX’s published StreamOne metrics, the platform serves more than 30,000 partners and 450,000 customers in over 80 countries and supports 22 currencies and 16 languages, with AWS, Microsoft, and Google available globally out of the box. TD SYNNEX also highlights a “normalization” layer in StreamOne that standardizes how software, lifecycle, and infrastructure are managed across providers so MSPs get a consistent ordering and billing experience even when they mix clouds. That marketplace serves as the core engine inside TD SYNNEX’s CloudSolv practice.

CloudSolv pulls together 900-plus ISV-driven cloud services and packaged migration or optimization offers that partners can bolt onto StreamOne subscriptions to create stickier, higher-margin bundles.

For MSPs building repeatable offers across regions, that scale and normalization matter as much as raw catalog size.

Ecosystem design also matters. AWS attracts ISVs that speak to DevOps teams and large enterprises with committed spend. StreamOne curates channel-ready vendors that bundle partner margin into every SKU and fund enablement programs. The catalog looks smaller on paper, but it aligns with the services you sell every day.

Discovery is the final angle. End customers often browse AWS Marketplace first and bring in partners later. StreamOne keeps you in front from search to renewal, preserving pricing control and support ownership.

In short, AWS gives you unmatched breadth inside one cloud, while StreamOne offers cross-cloud depth that mirrors the blended stacks most MSPs propose today.

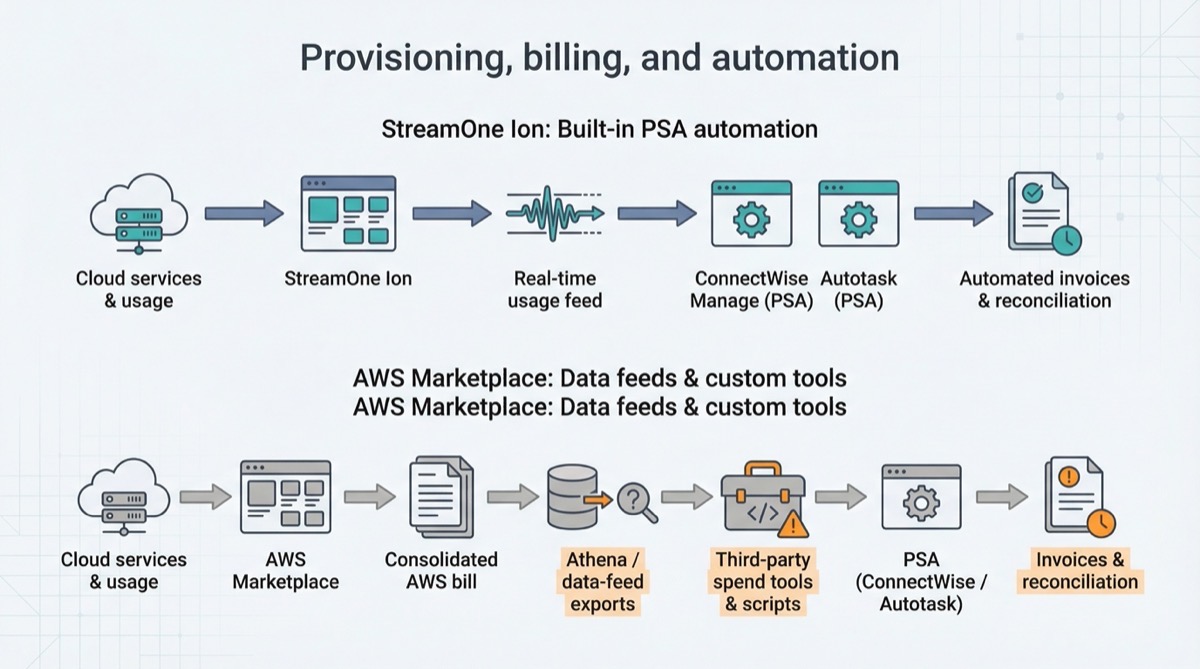

Provisioning, billing, and automation

Manual reconciliations drain margin. With StreamOne Ion, you skip that hassle. Real-time IaaS usage flows into ConnectWise Manage or Autotask through turnkey PSA connectors, and you can invoice continuously instead of waiting for month-end exports. Open commerce APIs also let larger practices embed ordering and metering inside their own portals or mobile apps.

AWS Marketplace tells a different story. All software charges roll into the customer’s consolidated AWS bill, but pulling line-item detail for multiple tenants requires Athena data-feed queries or third-party spend-management tools. AWS documents those steps for sellers, not for resellers, so you write extra scripts, add cost, and lose time when you serve dozens of small clients.

For most MSPs, the choice is clear. StreamOne automates billing and reconciliation out of the box, freeing your finance team to focus on insights, while AWS Marketplace demands custom plumbing before the same data reaches your PSA. When efficiency equals profit, built-in automation wins.

Partner margins and pricing power

Gross margin decides which deals you pursue. A 2024 Forrester study, reported by CRN, found that partners who resell through AWS Marketplace average about 13 percent gross margin, with cybersecurity offers reaching 18 percent. AWS also cut its seller listing fee to a sliding 1.5 to 3 percent and adds a 0.5-percent uplift on Channel Partner Private Offers. As a result, you often negotiate private offers or chase vendor rebates to widen your spread.

StreamOne Ion follows distributor economics. TD SYNNEX buys at wholesale, embeds your discount into every SKU, and charges no transaction fee. You can quote custom bundles and roll managed services into one monthly invoice without extra paperwork.

In practice, AWS gives you reach but makes you fight for each percentage point. StreamOne provides predictable margin and full pricing control from day one.

White-label experience and partner support

Brand control builds loyalty. StreamOne Ion delivers a customer-facing storefront you can badge with your logo, colors, and domain. TD SYNNEX hosts the infrastructure, so most partners launch in under a week and avoid hosting fees or patch cycles.

AWS takes a different route. With AWS Private Marketplace, large customers can create a branded catalog with a logo, title, and theme color, but the experience still lives inside the Amazon console and invoices carry AWS letterhead. You can curate products, yet Amazon remains front and center to the buyer.

Support shows the same divide. StreamOne assigns solution architects and billing specialists who join scoping calls and review monthly usage. TD SYNNEX says partners in its Cloud Practice Builder finish projects 35 percent faster than peers who lack dedicated help. AWS offers robust documentation and ticket queues, while hands-on coaching arrives only after you reach Advanced or Premier status in the AWS Partner Network.

If you value white-label control and high-touch guidance, StreamOne feels like an extension of your team. If global brand recognition and self-service scale rank higher, AWS Private Marketplace provides a workable option, though Amazon stays visible to your client.

When each platform wins

AWS Marketplace shines when the workload sits entirely on AWS, the customer wants to burn down pre-committed spend, and fast self-service procurement outweighs margin concerns. Canalys reports that 99 percent of AWS’ top 1,000 customers already hold at least one Marketplace subscription, and more than half of partners say their clients are “highly likely” to buy through a hyperscaler catalog. The reach is enormous, but you trade a slice of margin and invest time in extra billing integration.

StreamOne Ion wins when you need multi-cloud flexibility, predictable wholesale discount, and a storefront that wears your logo. TD SYNNEX notes that partners who launch the white-label store cut onboarding time to under seven days and recapture an average five hours per customer per month in automated billing tasks. Those efficiencies and built-in margins protect profit even on smaller deals.

Microsoft commercial marketplace (Azure Marketplace and AppSource)

If your stack centers on Microsoft cloud, this marketplace deserves attention. Azure Marketplace targets IT pros deploying infrastructure, while AppSource surfaces SaaS that connects to Microsoft 365 and Dynamics. Together they now list tens of thousands of solutions, and Microsoft reported more than four million monthly active buyers in 2024.

The draw is native integration. An offer purchased in Marketplace lands inside the customer’s Azure tenant and reduces enterprise-agreement commit. Firewalls, AI services, and Power BI visuals deploy in minutes and appear on the same Azure invoice.

For publishers, Microsoft keeps a three-percent store service fee on transacted offers, one of the lowest among hyperscalers. That modest take fuels rapid catalog growth, especially in AI and security.

The trade-off is resale control. Marketplace was built for direct purchasing, so MSPs still rely on the Cloud Solution Provider program or a distributor such as StreamOne for core licenses and multi-vendor bundles. Treat the marketplace as a lead accelerator rather than a billing hub.

Where it excels is co-sell. Listing a consulting or managed-service offer flags you to Microsoft field sellers. Partners enrolled in co-sell see up to three-times larger deal sizes than non-listed peers, according to Microsoft’s FY25 partner data. Combine that exposure with your CSP tooling and you create a flywheel: discover, deploy, expand.

Bottom line: if you spend your day in Azure, Microsoft’s commercial marketplace will not replace a distributor platform, yet it speeds deals and deepens stickiness whenever Microsoft is the cloud of choice.

Pax8 cloud marketplace

Pax8 set out to “make cloud easy,” and partners agree it delivers. The marketplace now lists about 120 channel-vetted vendors, ranging from Microsoft 365 and AWS to security, backup, and voice, and it serves 35,000 MSPs across North America, EMEA, and APAC.

Usability first. You can spin up a new Microsoft 365 tenant, attach endpoint protection, and sync charges to ConnectWise or Autotask in just a few clicks. Pax8 says partners who enable PSA integration cut three to five hours from every month-end close, time once lost to CSV reconciliations.

Enablement built in. Pax8 Academy layers sales coaching, technical bootcamps, and on-demand courses on top of the catalog, while a professional-services desk tackles migrations or complex Azure builds when you need extra hands.

Margin model. Pax8 sells at wholesale and charges no transaction fee, so you set retail price and keep the spread. The trade-off is breadth. Niche SaaS outside the curated list may still require a second supplier. A turnkey customer storefront is in beta; you can expose items through open APIs today, but a full white-label portal calls for custom work.

For fast-growing MSPs that value automation and coaching, Pax8 feels like a knowledgeable co-pilot. Pair it with a broadline distributor for edge-case apps and you cover nearly every recurring-revenue scenario without adding more portals.

Ingram Micro Cloud Marketplace

Ingram Micro is the elder statesman of distribution, and its Cloud Marketplace aggregates more than 200 cloud services from over 200 vendors. The catalog spans Microsoft 365 and Google Workspace through niche vertical apps you may not find elsewhere, helpful when a proposal needs an uncommon backup tool or regional compliance add-on.

Scale appears in finance as well. Ingram runs credit and financing programs in 160 countries, so you can quote services in local currency and settle in U.S. dollars, a plus when a multinational deal crosses tax zones.

The storefront rides the CloudBlue engine. Recent UI updates added one-click provisioning, PSA connectors, and a white-label Cloud Store you can brand without writing code. Larger MSPs even license CloudBlue to build private marketplaces, proof of the platform’s depth.

Support mirrors Ingram’s size. Regional solution architects, marketing funds, and extensive training are available, though you may navigate a wider org chart to reach the right specialist. Many partners accept that trade-off in exchange for buying power and global reach.

Bottom line: when catalog depth, international billing, and enterprise-grade tooling top your list, Ingram Micro Cloud sits comfortably beside nimbler players like Pax8.

Conclusion

Most successful MSPs do both. StreamOne powers day-to-day service delivery, while AWS Marketplace private offers capture net-new leads inside the Amazon ecosystem. Canalys projects that more than 50 percent of marketplace sales will flow through the channel by 2027, so running a dual-platform approach positions you to capture growth without losing control.